As the hope of resuming our pre-pandemic lives grows brighter, we’re turning our attention to the ways in which our economy and the eCommerce landscape have changed. A few months back, I wrote a blog post examining how COVID-19 stay-at-home orders upended digital marketing. While the unusual results we observed (detailed in the blog post) were positive for the majority of our clients, that period created uncertainty for everyone about how the rest of the year would unfold.

Braced with the unfortunate knowledge that infections would remain high, our team strategized under the belief that holiday shoppers would be compelled to buy online. Strong demand during the stay-at-home period also indicated that demand would remain high during the holidays. Overall, we anticipated unprecedented click volume, with much of that new traffic going to Amazon.

Now with the 2020 holiday shopping season behind us, the data paints a story of new shopping habits emerging during the pandemic. Clicks rose to record levels for our clients as more holiday buyers moved online. Surprisingly, mobile growth slowed dramatically, which is good news for eCommerce since conversions are higher on desktops. And for the first time, Black Friday was the biggest shopping day during the traditional post-Thanksgiving holiday kick-off period. While this new information provides a glimpse into the holiday shopper’s mindset, it also offers cues for how businesses can position themselves for success in a post-pandemic world.

Overall Holiday Shopping Data

While the full picture of the 2020 in-person holiday season has yet to emerge, early results show considerable growth in eCommerce sales and a decline in in-person shopping. Mastercard SpendingPulse data shows:

- Total holiday retail sales (excluding automotive and gasoline) grew by 3%.

- Online sales grew by 49% compared to 2019.

- Department stores saw a 10.2% overall sales decline. However, their online sales grew by 3.3%.

- eCommerce accounted for 19.7% of overall retail sales. That’s up about 13.4% from 2019.

Amazon also saw a record holiday season. In a blog post, the online giant shared that “through Cyber Monday, 2020 has been the largest holiday shopping season so far in our company’s history thanks to customers around the world.” Independent Amazon sellers also had a BIG holiday season. According to the company:

Independent “sellers saw over $4.8 billion in sales through the two shopping days worldwide, an increase of 60 percent over last year.”

This data reveals that people turned away from brick and mortar shopping and moved online in record numbers last year. A look at LP client data reveals a few crucial themes businesses should consider as we move into 2021 and beyond.

2020 Holiday Shopping Themes

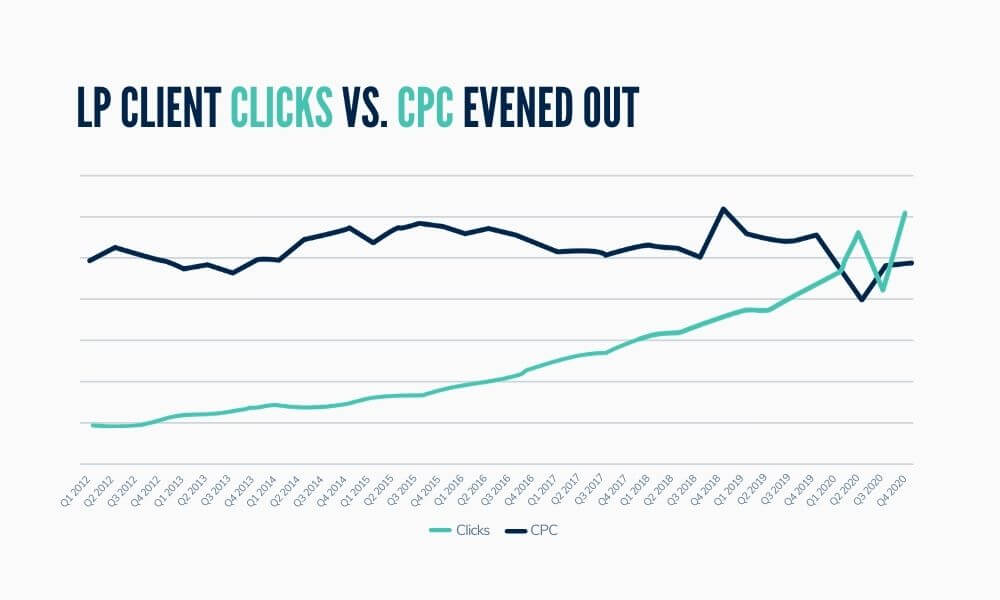

By summer, Amazon had returned to the search marketplace, which pushed click and CPC numbers back to the mean. As we entered the fourth quarter, Amazon eased back a bit but were still big search competitors. By the end of the year, clicks shot up to record numbers as buyers flocked online.

LP Client Clicks vs. CPC Evened Out

This graph of historic click and CPC numbers for LP clients shows the unique inversion that occurred during March and April. These numbers rebounded to the mean in Q3 until clicks skyrocketed to record levels in November and December. Among our US dollar clients, we saw:

- A record of more than 126 million clicks in Q4.

- Clicks were up 47% year over year.

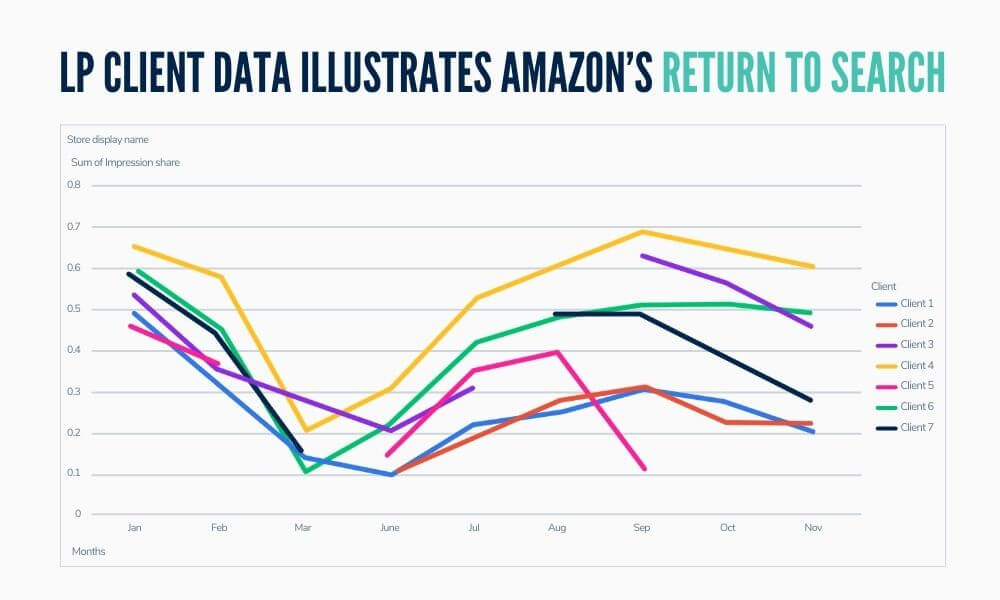

LP Client Data Illustrates Amazon’s Return to Search

Amazon’s participation in SEM has had a big impact on digital marketing this year. When we charted their impression share — which is a measurement of search ad performance — against LP clients throughout 2020, the larger story became clear.

As the graph lines dip in March, we see the tech giant’s relative absence from the search market during the spring. The graph also shows Amazon’s strong return to the market in July, before backing down again during the holidays. While these numbers only represent our client data, it offers a snapshot of the larger SEM marketplace. Seeing that Amazon was still an active competitor for clicks during November and December — even to a lesser degree — explains why our clients’ CPC numbers held steady, rather than dipping as they did in March and April.

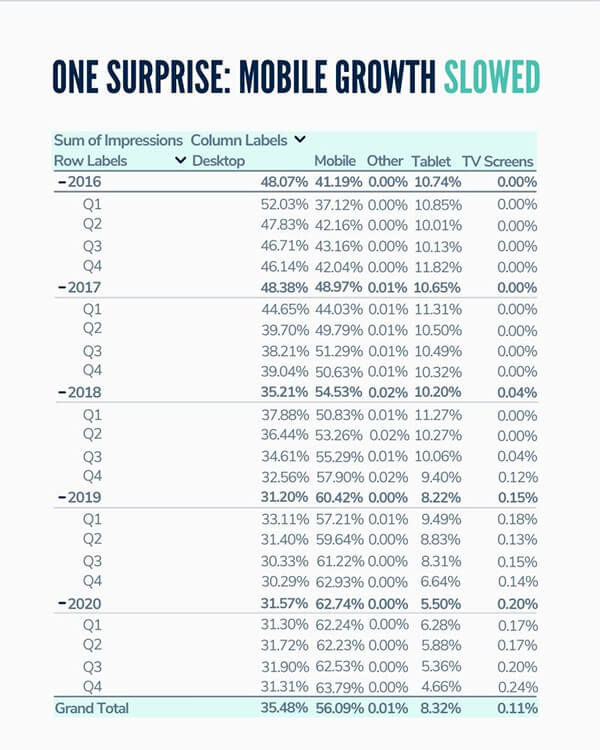

One Surprise: Mobile Growth Slowed

Mobile growth has been gradually slowing since 2017. However, we were surprised to see that growth drop dramatically in 2020.

- 2017: 19% YOY mobile share growth

- 2018: 14.5% YOY mobile share growth

- 2019: 8.73% YOY mobile share growth

- 2020: 1% YOY mobile share growth

Of course, more people than ever are working from home. So much of this decline is likely due to people shopping from their desktop computers. However, I wouldn’t be surprised if this trend continued, which would be great news for eCommerce. No matter how much mobile infrastructure is in place, it’s still easier to purchase on a desktop, which is why conversions are so much higher on these devices.

Five Takeaways from “Turkey Five”

We also noticed significant changes during the so-called “Turkey Five” period — the high-volume shopping days between Thanksgiving and Cyber Monday.

- For the first time ever, Black Friday was bigger than Cyber Monday. This is probably because people who traditionally shopped in stores on Black Friday moved their buying online.

- Thanksgiving was more critical than ever. Marketers had to recognize this early and adjust their campaigns accordingly.

- Cyber Monday is typically slower in the morning and busier in the evening. But with more people working from home, activity spread out more evenly throughout the day this year.

- The entire Turkey Five period flattened. Activity that would have come primarily on Black Friday and Cyber Monday spread out more evenly.

- The days preceding the Turkey Five were more important as big-box retailers adjusted their online approach.

These unusual results show a massive increase in online shopping and point to a possible change in shopping rhythms during this critical period.

Where Do We Go From Here?

Absent the pandemic, we would have seen continued year-over-year online sales growth. However, COVID-19 accelerated existing trends and pushed online shopping to a level we might not have reached for another decade. So how should businesses respond?

It would be a mistake to believe that brick and mortar shopping will return to pre-pandemic levels. These accelerated results point to a permanent shift in consumer behavior. With that in mind, small businesses should move aggressively to invest in their eCommerce infrastructure. That means setting up a high-quality digital storefront, driving new traffic through search advertising, and collecting relevant marketing data from website visitors.

Even though 2020 has been very dark for many people, 2021 welcomes bright spots ahead. While the economy is struggling right now, the eCommerce category still managed to have a record year. As more people than ever turned to online buying during the pandemic, I expect there will be even more opportunities to succeed here as the overall economy improves. If small businesses can weather the current storm and turn their energy towards investing in their online presence, the conditions are ripe for amazing growth in post-pandemic America.